Investing can appear to be a daunting challenge. But the underlying principles are very simple: buy an asset that other people need and hold onto it. It could pay you dividends (literally and metaphorically) in the years to come.

Nothing stirs more controversy in the investment world than real estate. On the one hand, it is a physical immovable asset many financial investors struggle to comprehend. On the other hand, it is intricately linked to financial assets and shares many similar features. What is an indisputable fact is that it has given birth to more billionaires (and millionaires) than any other sector.

Here we will look at the “how to” factor in real estate investment.

Why invest in real estate?

Real estate is either land or a building(s) alongside and any natural resources found there. They are physically tangible assets with inherent utility (and hence value). More importantly, land (especially residential land) has always been a scarce commodity and will become ever more valuable as urbanisation continues.

Real estate generates return in 2 forms: income (from rent) and capital appreciation (from the increase in value of the underlying asset).

A key differentiator between real estate and most financial investment instruments is the ability to leverage during the purchase. As a result, investor returns (both income and capital) can be significantly magnified, leading to exceptionally high ROI if timed correctly.

Why choose Switzerland?

Wedged between France, Germany and Italy, the Alpine nation of Switzerland is a country many have considered to be a safe haven for centuries. It is easy to see why when one considers the advantages:

• Political stability due to declared neutrality

• Peaceful existence as a sovereign nation

• Economic stability based on a developed economic model and prudent monetary/fiscal policies

• A highly sophisticated financial sector

• Advanced HDI (2nd in the world) and high standard of living

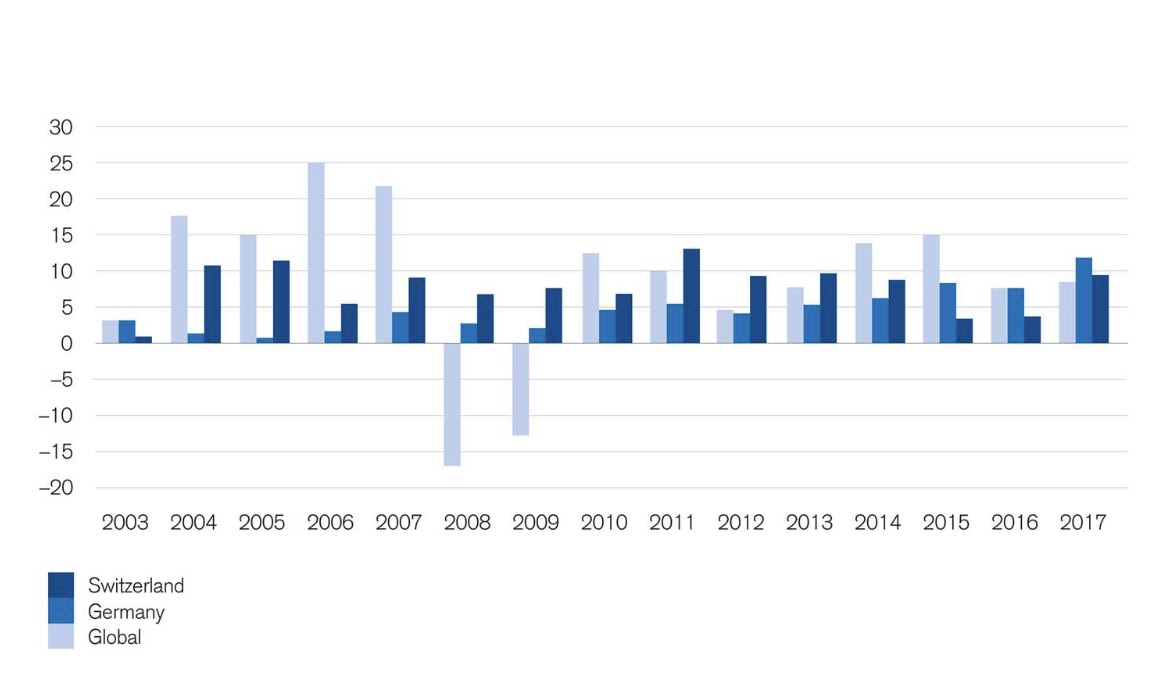

• Low correlation with the global financial market, as illustrated in Figure 1.

• A deep and special relationship with the EU and a member of the Schengen Zone

Figure 1. The CH market has shown little correlation with the global RE market during the Great Recession.

Types of real estate

Real estate encompasses a broad category of assets with myriad sub-categories and RE-derived investment products:

- Residential

- Apartment

- Houses

- Holiday homes

- Undeveloped land

- Commercial

- Office space

- Warehouse

- Retail stores

- Mixed-use spaces

- Agricultural

- Grazing land for livestock

- Crop land

For most of this guide, we will be talking about residential properties as an investment asset because they are most abundant, accessible and require the least specialist knowledge.

Average returns of different types of underlying properties in Switzerland

| Type of properties | Typical returns * |

| Residential | |

| Apartment | up to 5% |

| Houses | up to 4% |

| Holiday homes | up to 4% |

| Fractional ownership | up to 10% – 15% |

| Undeveloped land | Depends largely on the location and use, potentially unlimited |

| Commercial | |

| Office space | 3 – 8% |

| Warehouse | 2 – 7% |

| Retail stores | 2 – 5% |

| Mixed-use spaces | 5 – 8% |

| Agricultural | |

| Grazing land for livestock | 1 – 2% |

| Crop land | 0.5 – 1% |

* The numbers assume no bank leverage applied

What are the key levers in real state investments?

Broadly speaking rental and property prices are dependent on two main factors: demand and supply. Put simply, if the demand for properties exceeds supply then prices will rise. If the market is flooded with unoccupied houses then prices will drop.

The supply of property is relatively fixed in the short-term (houses cannot be built overnight). In the long-term, supply is also much less elastic than demand due to zoning laws and the overall land availability. As a result, we will focus on the demand side.

Key factors influencing demand for properties:

• Population demographics: the greater the population, the higher the demand for housing (everyone needs a roof over their heads)

• Economic growth: the higher the growth, the more disposable income citizens have to play with

• Foreign direct investment (FDI): as the economy improves, its attractiveness as an investment destination not only rises in the domestic market but also to international investors. As a result, foreign capital will increase and distort the demand of the local market.

• Tourism: this is an indirect derivative of FDI. As the economy matures, it becomes increasingly attractive to visitors, who also need temporary accommodations. This adds an additional layer of demand on the market.

• Interest rate: this affects demand for housing in 2 ways. Firstly if the rate is lowered, then it makes bank deposits (the safest form of investment) less appealing. As a result, investors may deploy the cash elsewhere, channeling part of it into the housing market. Secondly, low rates lowers the cost of borrowing. As property is a leverageable asset, it means mortgage is cheaper to both prospective homeowners and investors alike, thereby increasing demand.

The different ways to invest in Swiss residential properties

Now that you are familiar with the key drivers of property prices, you may be rightly wondering: how do I gain exposure?

There are multiple ways to invest in RE, which coalesce around 2 themes: direct and indirect investment. Below is an overview.

| Method | Type | Overview | Entry barrier | Transaction cost | Management cost | Return profile | Liquidity | Leverage |

| Self managed | Direct | Buying a property and managing it yourself | $100k min | 3-10% depending on the location | 1-5% per year | Capital: 3-5% per year Rental yield: 3-5% per year |

Low | Up to 60% LTV |

| 3rd party managed | Direct | Buying a property and use an agent to manage on your behalf | $100k min | 3-10% depending on the location | 5-10% per year | Capital: 3-5% per year Rental yield: 3-5% per year |

Low | Up to 60% LTV |

| Fractional ownership | Direct | Buying a share (%) of a property. This can be direct or indirect (in the form of an SPV) | $50k min | 3-5% | Nil | Capital: up to 3-5% per year * Rental yield: up to 7-14% per year * |

Low | Up to 60% LTV* |

| REITs | Indirect | Invest in funds that invest in real estates | $1k min | $5-15 per transaction | 1-2% per year | Capital: 5-10% per year Rental yield: 3-5% per year |

Instant | None |

| Property funds, ETFs | Indirect | Invest in funds that invest in real estates | $1k min | $5-15 per transaction | 1-2% per year | Capital: 5-10% per year Rental yield: 3-5% per year |

High | None |

| Real Estate Crowdfunding | Indirect | Similar to fractional ownership but the investor base is much wider | $100 min | 1% or less | 1-2% per year | Capital: 1-5% per year Rental yield: 2-3% per year |

Low | None directly, indirectly up to 60% LTV |

| Real estate bonds | Indirect | Lend capital to RE developers to develop projects | $50k min | Nil | 0-1% per year | Capital: nil Rental yield: 5-6% per year |

Low | None |

* depends on what fraction of the asset you own

Direct investments

Evidently there are a wide array of investment options available. To determine the optimal way to invest in Switzerland there are a number of vital decisions to be made first:

Determine your objective

This is the most important question and it will cascade to all the subsequent decisions that you’ll subsequently be making: what is your aim with the investment?

There are usually 3 drivers: security of capital, appreciation of capital and the quality of income streams. They interconnect and mutually affect each other so that the increase in one will cause a deficiency in another.

For example, if you are seeking the safety of your capital, you will want to be investing in central locations where demand is high. However you’ll be in competition with many other buyers, leading to higher purchase price. As a result, the rental yield will fall.

You might wish to finance the purchase using debt, however this increases your leverage and could magnify your losses (and return, more on it later).

On the other hand, yield-hungry investors will be more willing to venture out into non-central locations and perhaps even commercial spaces which inherently possess higher yields.

Finding a balance of these 3 factors that suits your aims and financial position is a sensible first step in establishing what kind of asset suits your investment. Since it will drive most of your subsequent decisions, take your time and think it through.

Decide who will manage it

Real estate needs careful management, as it doesn’t bring returns unless it has rent-paying tenants. On top of that, real estate is a physical asset and is vulnerable to damage.

There are 2 main ways to manage properties: self-management or 3rd-party management.

Self-management is an easy and cost-effective solution as the main cost is your time. It is however impractical if you are not based close to your properties. In this case, hiring a professional 3rd-party agent might be the best option. They handle most of the daily tenancy operations, rent collection and maintenance.

You should budget between 10-15% of your gross rent on agency costs.

One way to reduce management cost is to pool resources and use fractional ownership, as explained later on.

Select the asset type

Different real estate assets have vastly different return profiles. For example, most residential properties can be easily managed by the investors themselves or generic estate agents with minimal difficulties. The low technical entry barrier inevitably increases the supplier and thus dents the yield. On the other hand, commercial properties (e.g. office space, industrial warehouses) have relatively high yield (up to 8% in most cases). Yet they require specialist management and have higher entry price tag. It makes them far less accessible and appealing to retail investors.

As a result, most references here will refer exclusively to residential properties. More specifically, given the majority of the Swiss population dwell in single or multi-family apartments, we will use these properties as the foundation. This is because by conforming to the norm, you are maximising the accessibility of the property. This reduces tenancy void periods and increase sales liquidity.

Fractional Ownership

To those who may not have the capital (or who do not feel comfortable committing large amount in one go), fractional ownership offers the ideal combination of low barrier to entry, minimal hassle and yet offering market-leading returns.

It’s a type of investment that lets you use the advantages of real estate investing without having the risks attached to managing the real estate property. This is achieved by owning a share of a property (very much like being a shareholder in a company) and letting a professional team to manage it.

Recently, a Swiss prime hotel chain, Le Bijou, pioneered a new form of fractional investing in the hospitality industry.

Typical hotel business consists of two “fractions”:

• the business of hotel operations (high value-added activity, high margin, high returns)

• real estate ownership business (low value-added activity, low margin, low returns)

So far, when investing in a hotel, an investor was forced to own both fractions. It didn’t matter if he wanted to have the exposure to the less profitable real estate ownership fraction and the related risks – there was no other option.

Le Bijou revolutionized the investment model in the hospitality business. It offers an opportunity to invest discreetly in the hotel unit setup (the franchise, interior design, and renovation, Uber-like service system, marketing) without the need to also invest in the actual apartment where the hotel unit is set up.

Thus, investors can benefit discreetly from the highly profitable fraction of the business: hotel unit operations, without locking down their capital in something that yields a much lower interest rate: ownership of the building where the unit is set up (low value-added activity).

This has transformed a traditionally capital-intensive sector into a capital-light and high-margin business, returning 14% yield to investors in the past year.

Select your location

You might have heard, a property is all about its location, location, location. A house/apartment that is close to the central business district, near convenient social amenities (e.g. nice restaurants, schools, transport hubs) and which has low crime rates will obviously be more desirable and hence more valuable than one that isn’t.

The thinking behind the real estate mantra about location is very simple:

• Humans need to work, eat, be educated and be entertained in a safe and nice environment.

• People want to achieve all of the above with minimal effort.

As a result, a property that ticks all the boxes must have the perfect location. Unfortunately most properties don’t and therefore investors need to compromise and pick what is important to them.

This circles back to the original objective of the investor. If you are buying it as your holiday home, that will also hold value over time, a residence in a resort town could prove to be a sensible choice.

If however you want your to be occupied consistently, then you need to move closer to cities and ideally buy apartments (renters rarely want to take care of outdoor spaces). Amongst renters, single professionals want to be as close to the city centre as possible whereas families are more likely to seek a quiet suburb with good transport links and easy access to schools and natural outdoor spaces like parks.

Study the area where your property will be and establish what greatest demand of the local market is. Then, if you establish that there is a demand for properties that suit families, put yourself in their shoes. What would attract them to your property?

Are you willing to leverage?

There is an eternal debate amongst investors on the merits of leverage (using mortgage to partially fund a purchase).

Proponents believe that mortgages facilitate property ownership and can vastly improve the return on capital (you are using less than 100% capital to capture 100% of the gains) and enable you to diversify your portfolio base. Opponents argue that the opposite is also true where any losses are equally magnified.

The frustrating fact is that both sides are right!

Ultimately the decision comes down to the type of investor you are and what your risk appetite is. If you want to sleep absolutely soundly at night even when the world financial system is melting down then by all means, complete the transaction using 100% equity, if you can afford it.

However, if you want to achieve a slightly higher return, then there is no harm in introducing a small amount of mortgage into the purchase. Remember, each additional $1 of mortgage is another dollar you could invest elsewhere.

The key is to leverage in moderation. Financial leverage is just like a mechanical one. Too much stress would cause the pivot to snap. There are 2 critical ratios you need to be aware of:

1. Loan-to-value (LTV): this dictated the % of the asset value is made up of debt (rather than equity). The lower the number, the greater proportion of the asset you own, the lower the risk for banks and the better the interest rate you will receive.

2. Monthly payment: this is the amount of principal and interest you need to return to your lender each month. Since this will come out of the rent, it is obvious to state that this number should be less than your actual rent. In fact, it is advisable for the monthly mortgage payment to be no more than 50% of your total rent.

Choose your investment vehicle

Will you hold the investment under your personal name, your spouse or a non-natural person (e.g. a company or trust)? This may sound like a trivial legal formality but it has serious ramifications later down the line.

Many countries have restrictions against non-citizen investors in RE which range from additional bureaucracy, more taxation to any out-right prohibition. This could sometimes be partially mitigated by using a company registered in the host country. Yet this brings its own challenges in that mortgage lending may be difficult or expensive to obtain, not to mention the additional annual reporting requirements.

It is therefore advisable to seek appropriate legal advice before putting a name on the title deeds.

Wait and be patient

There are thousands of RE investment opportunities out there (after all nobody will refuse money). Yet finding the right one appropriate for your own circumstances may be less straightforward. Seeking the right opportunity is a lot like hunting, where you need a tremendous amount of work to prepare yourself (e.g. listing down your requirements, arranging finance, setting up legal bodies etc) in order to be ready to pull the trigger when the opportune moment arrives.

Remember, the right opportunity doesn’t present itself all too often so you need to be as ready as you can to take full advantage of them when they appear.

Indirect investments

Indirect investments is where you do not directly become the owner of the property, but instead, you become a shareholder in a company (a special purpose vehicle, SPV) which in turn owns the company on your behalf. This is a common method to pool capital together from various investors and complete a larger transaction. It allows investors to obtain institutional-level management and performance without needing to amass significant capital.

Below is a comparative overview of the key indirect investment avenues in Switzerland:

| Asset type | ETF | REITs | Crowdfunding | Fractional ownership |

| Example | UBS ETF (CH) – SXI Real Estate® Funds | SWPRF | Crowd House | Le Bijou Owners’ Club |

| Overview | This is an ETF that invests in real estate funds contained in the SXI Real Estate® Funds Broad Total Return. | Swiss Prime Site AG is a listed property investment company which a portfolio value of around CHF10 billion and consists primarily of commercial and retail real estate. | To become a shareholder in a company (SPV) which in turn owns Swiss properties. | Become a shareholder in an SPV which in turn own or lease apartments in prime locations and transform them into luxury hotel units. |

| Return profile | Averaging 4% per annum since 2015 | 3-5% per annum over the past 5 years | 6.4% return on equity per year since 2015 | 7-14% per annum since 2011 |

| Yield | 1.65% paid annually | Currently doesn’t pay dividends. | Nil | up to 7-14% per annum, paid yearly |

| Entry threshold | As specified by your broker, recommended minimum level CHF 1,000 | As specified by your broker, recommended minimum level CHF 1,000 | Minimum CHF 100,000 | Minimum CHF 50,000 |

| Management cost | 0.95% TER | Broker commission, usually around CHF 10-15 per trade | 4% (plus VAT) management charge per year 3% exit fee upon successful sale |

Nil |

| Liquidity | Instant | Instant | Low – needs to be sold to a willing buyer, which takes time to find. | Illiquid, needs to be sold to a willing buyer, which takes time |

How to invest in Switzerland if you are a foreigner?

Switzerland has strict rules when it comes to foreign investments in real estate.

According to Expatica, you can purchase a property if :

• You are an EU or EFTA national with a Swiss residence permit who resides in Switzerland

• You hold a Swiss C Permit

• If you hold a Swiss B Permit, you may also purchase a property, but only to live in, not as an investment

Licensing criteria are different from canton to canton, but the preference is given to applicants looking to purchase a primary residence.

In conclusion

Switzerland offers a tremendous range of investment opportunities with a hugely diverse RE market. Its economic stability coupled with the well-developed financial system means investors will never be short of options when it comes to properties. Take your time, do your research, get a feel of the environment and you will be richly rewarded.