Rating

How to Open an Account in a Swiss Bank: Wealth Manager Explains the Procedure

If you’ve ever been concerned about the security and stability of your wealth, or perhaps wanted to take advantage of special banking services unavailable anywhere else, then you’ve probably thought about opening a Swiss bank account.

That’s because in times of economic turbulence Swiss bank accounts are always in vogue. Not that they are ever unfashionable. They’ve been a quintessential part of the investors toolkit for decades.

But for those investors who haven’t yet secured an account, there are now many excellent options to compare. However, before you get your hopes up, it is worth noting; Swiss banks are no longer shy about refusing bank account applications that don’t pass the smell test.

Once upon a time, anyone with a suitcase full of cash could open a secret Swiss bank account, without anyone batting an eyelid. Not anymore! A lot has changed over the past few decades and the Swiss authorities have significantly strengthened banking laws.

They also have bilateral agreements with certain countries, in which they agree to give their client’s information, for specific, valid reasons. However, the Swiss still value the right of secrecy and will not disclose your identity or your account information very easily.

Though it is not always easy for non-residents to open a bank account, if you have sufficient funds and a clear purpose, you probably have the basic qualifications to apply for a secure Swiss bank account.

To find out more, we asked renowned wealth management expert Kirill Nikolaev, a Managing Partner of NICA Multi-Family Office in Geneva, to offer his thoughts about the modern Swiss banking system. And for some tips new entrants should consider before deciding to open a Swiss bank account.

What makes Swiss bank accounts so prestigious?

There are plenty of reasons why having a Swiss bank account is considered essential by successful investors.

- Political Stability: Switzerland has been a neutral country for the past few centuries. This means that instead of focusing its energy fighting on battlefields, the nation has directed its efforts towards fostering its development and wellbeing. As a result of its politically neutral stance, the country is considered to be one of the safest places for storing and growing wealth.

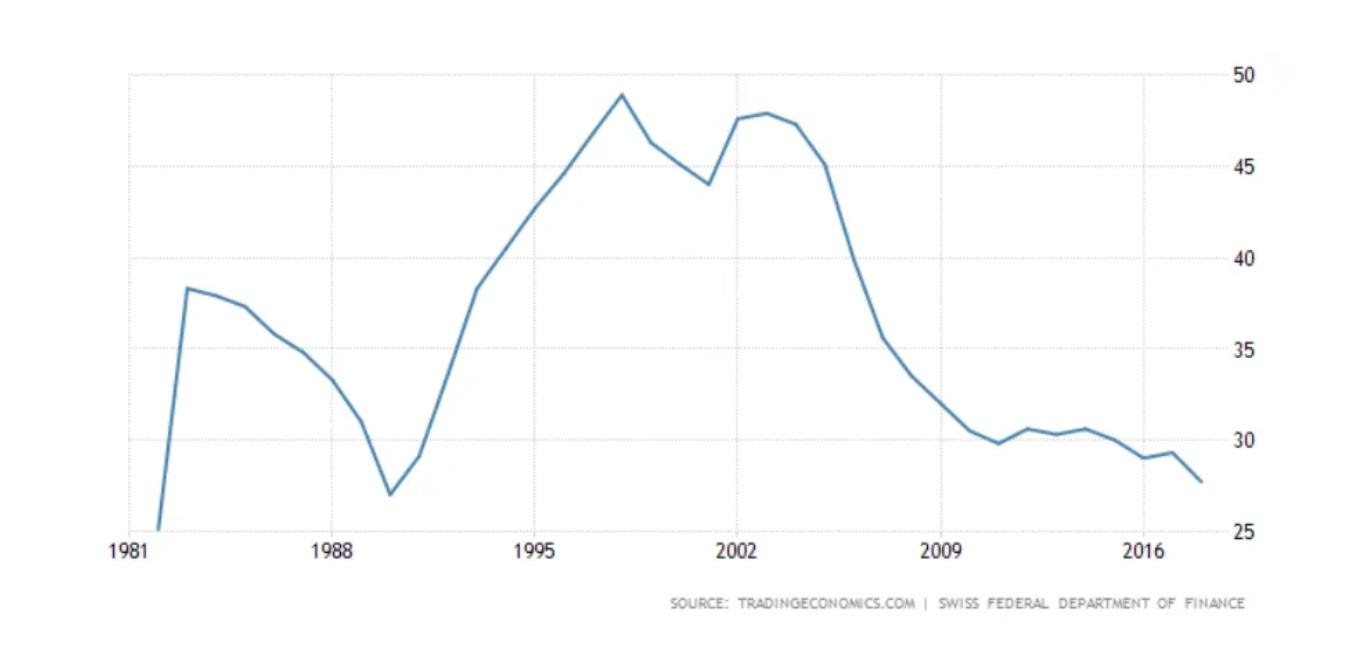

- Economic Stability: Switzerland’s conservative policies keep the country on track for consistent growth. Yes, you won’t see big economic upswings (one might call them bubbles), but you also won’t see the downsides either: severe lows or prolonged recessions. The Swiss economy is never on a roller coaster ride. Switzerland’s government debt-to-GDP ratio has never been higher than 48.9%, and in fact, stood at only 27.7% last year. In comparison, the government debt-to-GDP ratio in the United States is over 100%.

Switzerland Government debt-to-GDP ratio, 1980 – 2020

- Low level financial risk: Many Swiss banks such as Zurcher Kantonal Bank, Postfinance, etc. have a state guarantee for the total account balance of up to 100,000 CHF. This means that the state of Switzerland itself guarantees that your money will be secure up to this amount even if the bank fails for some reason. Other banks such as UBS and Credit Suisse are so big that they can sustain their financial positions even in times of crisis.

- Elite level of privacy: Swiss banks’ reputation is based on trust, so they can cooperate with tax and criminal investigations – but even today, Swiss banks give a level of privacy unavailable anywhere else in the world.

How to choose a proper Swiss bank

In Switzerland, banks are loosely divided into several groups:

- The Premier League: First of all, these are top-level banks such as UBS, Credit Suisse and Julius Bär. These three banks actually dominate the market in terms of volume, number of employees, relationships with institutional groups, etc. They also have an international presence.

- Middle League: Next is the Middle League, or League Two. These are smaller banks that are incorporated in Switzerland, but do not have many international branches. These banks include such institutions such as Banque Bonhôte & Cie SA, J. Safra Sarasin, Migros Bank, Zurich Cantonal Bank, etc.

- Boutique banks: Then there are very small, privately-owned banks, such as Mirabaud, Swissquote, WIR Bank, etc. These banks provide very personal services to a small number of very rich clients.

As a rule, in the premier league, banks have the most severe requirements for the selection of customers. Naturally, what they offer depends on the situation in the market, but each bank has a so-called minimum amount of liquidity that needs to be in the account. And this volume in the first major league banks is usually the highest.

Citizens of Russia and the CIS for example. Usually they need to maintain at least 100 million euros. Although we know of exceptional cases – sometimes as low as 10-15 million euros – most elite bankers generally don’t accept deposits of less than 50 million euros.

In terms of secrecy, Swiss law forbids the banks from disclosing any information regarding an account or even of its existence, without the client’s permission. So as far as secrecy goes, there is no difference between a large bank such as UBS and any one of the smaller banks.

Some Swiss banks promote secrecy as a selling point – that they offer more privacy to their account holders, than banks anywhere else, but Nikolaev says this can lead to misconceptions.

And although Swiss bank accounts are world-leading for privacy and confidentiality, they will always make sure their customers are genuine and they certainly won’t turn a blind eye to criminality:

“Оften small banks portray a scenario that if God forbid, something bad happens to you in your own country, then a request from the prosecutor’s office or from the court from your country will most likely arrive in the big banks of Switzerland, and since they are too small, and unknown to most of the world, no one will send them a request for information about your account. And if there is no request, then they don’t have to give any information to anyone. This is partly true. However, if we are talking about the request of information with tax authorities at a government level, then it does not matter what size the bank is.” said Nikolaev.

What do Swiss banks look for, before approving an account?

Broadly speaking, there are two types of client looking to open a Swiss bank account. The first lives outside of Switzerland. The second lives in Switzerland. Banks treat these cases individually.

For non-Swiss residents, these are the two main areas that the bank will carefully analyse. Banks want to get a solid understanding of both, before they approve or refuse your bank account application.

- The first is the background profile of the bank account applicant

- The second is about the capital to be deposited and maintained in the bank

Essentially, the bank will be looking to verify the public identity of the applicant and proof of his legal and financial eligibility.

They will look for information available about you in the public domain. So before applying, make sure there are no negative publications or references that might influence their decision. Have you ever been involved in any public scandals or legal proceedings? Because if you have, a Swiss bank may well consider that a red flag, and refuse the application.

They will be making sure, during basic, first-level screening, that they are not dealing with criminal or politically blacklisted citizens. These may be current officials or former officials in governments, their agencies, or other positions of public office. Citizens under sanctions in certain countries can also be refused.

If the individual himself is directly involved in some kind of criminal or political activity or officially being investigated, then it is practically impossible to open a Swiss bank account. Even if some time has passed and he was a former government functionary, then most likely the bank will refuse.

The second issue is what we call the origin of capital. And here, the first thing the bank asks for is to explain the origin of the capital and then confirm it with authentic documents. Previously, about 20-25 years ago, this was merely a formality, but now this is taken very seriously.

According to Nikolaev, the new law changes were important and have improved the banking system, unlike the previous era where no questions were asked:

“Some Swiss bankers recall with nostalgia the times when customers came with a suitcase of money, in cash, and bankers, looking into their eyes, asked, ‘Where did this money come from?’ They answered something and it suited them. No one asked unnecessary questions.”

Now they are asking for documents that explain the origin of capital. And they probe deeply to confirm all claims. They also expect notarized documents from any country the documents originate.

So, if you sold an apartment, received an inheritance, or traded assets in the stock markets, they will ask for a whole bunch of documents. Where did you get these assets from? How long did you own these assets? And many other legitimate questions too. They all need to be certified by the relevant authorities, even if they are influential current or former politicians, says, Nikolaev:

“The former president of a post-Soviet country asked to become a client of our family office. However, we were forced to refuse, because, first of all, at that moment, he was in the field of view of law enforcement agencies and was under a potential criminal investigation. It makes no sense to take in the client if the origin of his capital cannot be explained at all”.

What the banks are looking for is to ensure that the client is absolutely transparent. He is never implicated in any negative publicity and there are no legal proceedings against him. They want to be certain he is not a criminal and that he is absolutely clean. There should be no track record of any wrongdoing.

Once it is clear the client is clean, the bank evaluates how much they can earn from that client. The bank earns money from commissions, from opening an account and from operations of an account.

Most banks do not like customers who just want to transfer 10 million euros and let the money lie in situ. Otherwise, the bank earns only a basic interest. Banks make money from commissions on investments.

That is often why banks choose to close an account. Because money lying dormant in an account does not earn any significant money. They are looking for dynamic sales and corresponding commissions for the bank. So they want to activate the maximum range of services they provide. Swiss banks look to approve clients that utilise their full suite of financial services.

How to increase your chance of getting your account approved?

The Swiss are proudly cosmopolitan, but should the applicant be a tax-paying resident of Switzerland, more harmonious relations with the bank are likely.

Banks always look at which jurisdiction the client resides but law-abiding residents of any nation may be accepted. In any case, the basic requirements for opening a Swiss bank account remain, but clients who obtain tax and residency status in Switzerland typically gain preferred status.

Can a bank change its mind and close an account?

Yes. A bank can review the client’s status at any time and can close an account if deemed necessary.

What nationalities can open an account?

Restrictions on nationalities vary from bank to bank and depend on the current political situation. For example, litigation by the US Department of Justice against UBS and Credit Suisse, has led to more stringent requirements for US citizens that want to open a Swiss bank account.

Swiss banks were accused of helping US citizens to avoid or reduce taxes that they had to pay the United States. It resulted in a huge fine for Swiss banks. And, of course, the financial crisis of 2008, had serious consequences. So legislators in the European Union and Switzerland worked to improve regulations to prevent illegal financial transactions on the continent too.

These regulatory changes resulted in the banks being even more careful about the type of clients they accept and also the type of assets they hold.

Does the nationality matter when opening a bank account in Switzerland?

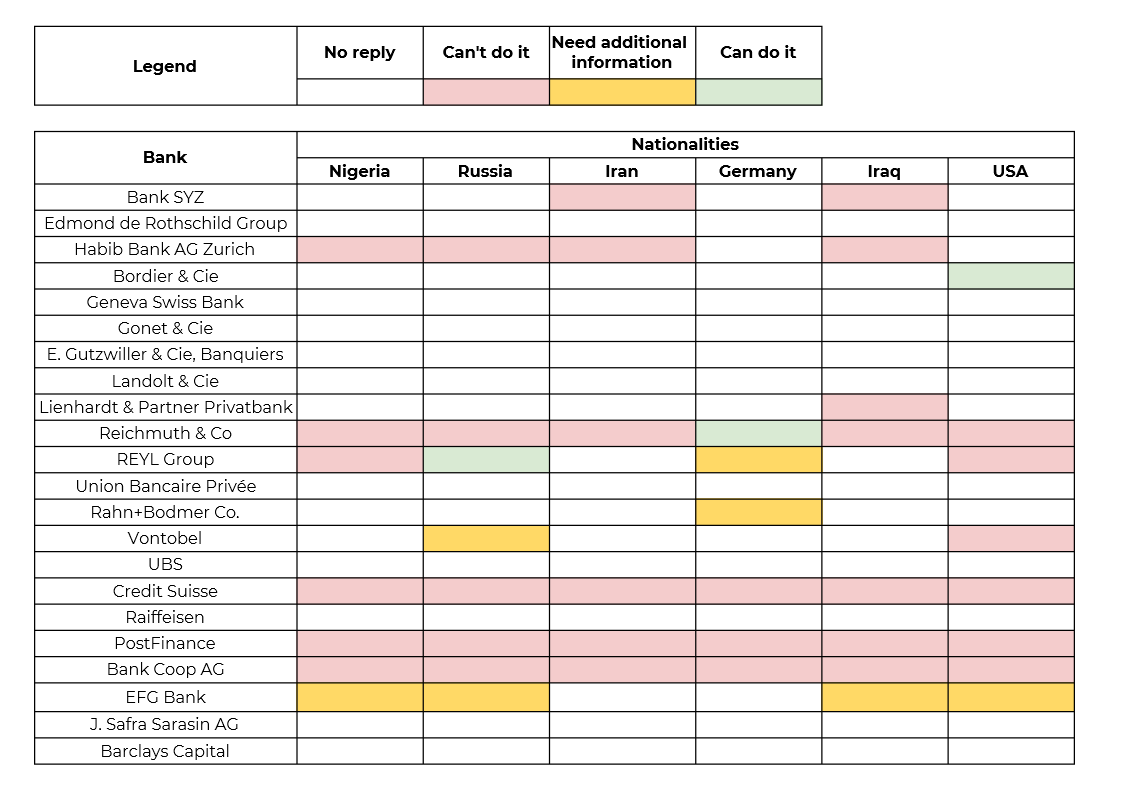

As a little experiment, we wrote to some top banks in Switzerland and asked them if we could open an account. For this purpose, we created several emails typical of countries from our research: USA, Iran, Iraq, Germany, Russia, Nigeria.

The results of the research are presented in the following table.

Swiss banks that replied to a foreigner’s request about opening an account

Swiss banks that replied to a foreigner’s request about opening an account

There are two main conclusions that that may be drawn from this study:

- If you just write the email as a regular foreign resident – they will most likely not answer. So, you might need another approach to establish dialogue with the particular bank. This might be an in-person visit or the help of an intermediary organization. But this research did show which bank will respond to which email, depending on the country of the client.

- It is clear that for prospective clients from Nigeria, Iran, Iraq and others, opening an account in Switzerland will not be that straightforward

But if you are from the USA, Germany or Russia, most Swiss banks can open an account for you, according to their own specific requirements.

What’s the procedure for opening a Swiss bank account?

Here are the main two ways of getting the ball rolling.

- The first is to walk-in to the bank and apply for an account as per their standard procedure.

- The second way is to go through a service provider. Banks like to connect through a service provider. Why? Because the service provider takes on many of their functions. First of all, they know the client, and they make the client go through the pre-compliance procedure. They do certain due diligence of the client. Banks always feel more comfortable when opening accounts with service providers. These may be law firms or they may be specialized companies that have expertise in opening accounts. Or it could be family offices. A family office is a company of financial experts that help you manage your wealth, purchase property, make investments, etc. Most of the bankers always prefer the second method. Normally, banks prefer not to interact directly with the clients. This may be due to the lack of a specific culture and the need to educate the clients about the Swiss banking culture and system.

If a client goes to open an account directly, then the process looks exactly the same as anywhere in the world.

The bank makes a request for many important primary documents from the client.

- For basic identity a passport is always required.

- Then documents related to the confirmation of the origin of capital. And, depending on the capital, these are various documents that the bank may request.

- There is the normal application form to be filled by the applicant. The client has to fill in answers to standard questions.

After that, the bank takes some time to begin the compliance check. After research, analysis and internal discussion, the bank then makes a recommendation about the prospective client.

If the evaluation is very simple and clear, the client is informed that a decision has been made. If the application is approved, the client must then physically visit the bank in Switzerland or perhaps to an affiliated branch outside Switzerland.

Major banks of Switzerland have branches around the world, so the client can usually submit the original documents to a bank branch in another country. Then, all that remains is for the client to sign an agreement with all the details for operating the account; including how to make and receive international transactions.

How much time does compliance evaluation usually last?

The time depends on the bank and the relationship the client has with the bank. It also depends on whether the client went to the bank directly or through a service provider. If the application is proved to be clear and clean, bearing all the hallmarks of a transparent client without complications, then generally, it will take about two to three months. On average, from the beginning till the time it is possible to use the account operationally, it will probably take from 4 to 6 months.

In cases of direct interaction, where the client approaches the bank, instead of through a trusted service provider, there is usually a higher risk of delay or even refusal.

How to choose a bank? How to choose a service provider?

Most newcomers to the world of Swiss banking are unlikely to understand the differences between the big banks like Julius Bär, UBS and Rothschild. But with a little patience and research there might be better options. So go ahead and scan the market first. Then chew over the possibilities.

Most customers choose exclusively from the point of view of external marketing. They see the brand of a Swiss bank and go there. But this does not mean you made a good choice. Because the larger the bank is, the larger the bureaucracy and the limitations that stem from that. There can be quite tough expectations and demands on customers.

Bank commissions vary of course, but the typical “all in” rate might be from 0.5 to 1% on an average per year. Family offices, for example, will charge 1% per year. At maximum, the client will pay 2% of the capital in aggregate per year. And if we add inflation to the US dollar, of around 2-2.5%.

If it turns out that the client does nothing at all with his capital and neither does the family office, then the capital will reduce by 4-5% in value per year. Therefore, the main task of family offices is to ensure that money is managed properly to repay commissions, overcome inflation and cover costs, so that the money does not lose value.

If you are considering a family office, pay attention to its reputation. Recommendations should be easy to find, as well as a track record of healthy interactions with various reputable financial organizations, banks and lawyers. It is important to pay attention to its jurisdiction too. Ensure they have a direct working relationship with Swiss banks. Get the basics right. It will probably be useless to choose a family office that specializes in Japan, if you want to open an account in Switzerland.

Choosing just the right Swiss bank for you is a daunting challenge. Get it wrong and you’ve wasted a lot of time and your money isn’t working for you. So many of the most serious and successful entrants to the world of Swiss banking, usually head towards a family office.

A family office gives customers a choice of several banks, explaining how they differ from each other. Most often, banks are responsible for the infrastructure that they provide, including investment.

The bank is the platform through which the client or family office, or the manager of the client’s account, gains access to certain financial tools on the world market. Each bank has unique characteristics, special advantages and drawbacks to consider, so it all depends on the client requirements.

Whatever you do, make sure you fully understand bank commission policies on the many various transactions the bank allows. That’s another advantage of the intermediary. A trusted family office keeps the client properly informed about the bank policy. Because commissions and fees vary hugely from bank to bank.

There’s also tracking the minimum balance requirement and number of financial instruments the bank expects the client to use. The bank may say “Yes. We all like it, our commissions will be low, but you should buy our structured notes or bonds of at least 3 million euros”.

When in doubt, keep it in the family

Swiss banks offer their clients low levels of financial risk and high levels of privacy – better than banks in any other country. Although now due to international agreements, Switzerland is obliged to provide account information about an individual, if requested through official channels.

Still, Swiss banks diligently maintain clients’ secrecy. Swiss banks now perform more in-depth due diligence about a potential client and the source of capital that he may be bringing into his account. This is to ensure that clients have a transparent past with no ill reputation and that the money is also clean.

Although it may be possible for an individual to open an account directly, banks usually prefer that a new account is opened through a trusted intermediary financial institution, such as a family office. These institutions undertake the process of due diligence about the individual and his funds. Their reputable services make the banks feel more comfortable in dealing with foreigners. Instead of dealing directly with an individual foreigner who is new to the banking culture of Switzerland.

Expertise provided by: Kirill Nikolaev, Managing Partner @ NICA Multi-Family Office