“There are two ways of being happy: We may either diminish our wants or augment our means.”― Benjamin Franklin

The quote above carries the truth behind the need for making investments. Whenever you have wealth, it’s important to seek ways to grow it. Otherwise it will diminish with time – that’s the burden that comes with wealth.

Real estate investments created more billionaires than any other industry in history. The need for housing is one of the basic human requirements and will never go out of style – just like the need for energy, clothing, transportation and communications. Although, unlike many other industries, real estate is much more stable and mature. It’s hard to think of a disruptive innovation that would bring property out of the playing field. In fact, some people still live in houses built during the 16th and 17th centuries and often consider them a luxury.

Le Bijou capitalizes on recent changes in the hospitality industry

It’s common even for mature industries such as real estate to find new ways to evolve and grow. Le Bijou has identified one such way and it’s early enough to build a lucrative business model based upon this niche.

Dropped entry threshold and the increased importance of high-quality service

After the invention of the internet, things started to change, especially in the hospitality industry. Online booking platforms such as Booking.com re-shaped the way people think about hotels. The importance of brand awareness dropped dramatically – virtually any boutique hotel could now compete with industry giants as equals, without the need to put billions into advertising. As Amazon Founder Jeff Bezos puts it: “In the old world, you devoted 30% of your time to building a great service and 70% of your time to shouting about it. In the new world, that inverts.”

The struggle for privacy

Now consumers have become overwhelmed by constant, brief social interactions with people they don’t know and probably will never meet. Privacy and the freedom to choose whether we want to interact with others or not is now a luxury few can afford. When traveling, there’s nothing pleasant about the check-in process. Most people do not enjoy sharing the elevator with other guests or stumbling upon (rich) strangers in the lobby.

The appearance of AirBNB was another shake to the hospitality industry. Not only did it bring independent homeowners to the market, but it also impacted consumer tastes, as it perfectly matched the increased need for privacy.

We were operating a small apartment through AirBNB in 2013 when we realized that almost half of our customers were high-spending, sophisticated visitors. We found they preferred this type of travel booking because:

- They liked the privacy and convenience of renting out the whole apartment.

- They felt in full control of the place.

- They didn’t have to interact with anyone, including reception and security personnel.

- They would never have to stumble upon another guest in the lobby.

Overall, the experience was more like staying in a private apartment; more like home and less like a hotel.

The underserved luxury customers and Le Bijou’s concept

Even though AirBNB apartments are widely available, luxury consumers are rarely satisfied. AirBNB properties are seldom operated professionally and lack the amenities that a 5-star service would provide – concierge service, great design, professional operations, and a guaranteed level of service. Many travelers expect to rent the whole floor. And most importantly, many guests weren’t excited by the idea of staying in someone’s private apartment that could be accessed by the homeowner at any time. They needed a brand and an institution they could trust. Something that would maintain their desired level of privacy while upholding the emphasis on service they received with traditional bookings.

Steve Wozniak, co-Founder of Apple, about his stay at Le Bijou:

That was the beginning of Le Bijou. As soon as we realized that such a lucrative segment as luxury consumers is underserved, we saw a great business opportunity. We came up with the concept of a modular hotel that would combine the convenience of renting out whole apartments with the prime services and safety of 5-stars hotels. We invested in the first units and since then, we’ve managed dozens of apartments in Europe, working with our own capital, also by banks and private investors.

What is Le Bijou?

Le Bijou is a modular, high-end hotel that operates in major Swiss cities with plans to expand to the world’s largest trade and business centers.

Le Bijou’s units are large apartments in prime buildings in the central areas of each city. Every apartment has a unique interior design, top-class amenities, and a great view. Even taking up the whole floor is an option.

All the services that a 5-star hotel would provide are at the visitor’s fingertips: James, our digital butler (backed by artificial intelligence) and the face of our sophisticated concierge service, can handle anything a customer might want, whenever they want it – be it private dining, events booking, transportation or security services.

Inside one of Le Bijou Units

Le Bijou occupancy rate is usually between 75% – 85%. We plan on opening dozens of new units in Switzerland to face increasing demand, and we expect to move next to other major business centers across the globe, including London, Dubai, Hong Kong and New York.

We leverage both institutional and private capital to finance our expansion, and offer two types of investments for retail investors who would like to participate in the growth of our business.

How does it work from the financial perspective?

Le Bijou is looking for apartments in the center of Swiss cities in the most desirable locations. We buy or rent them, create luxury interior designs and then rent them out for short-term stays.

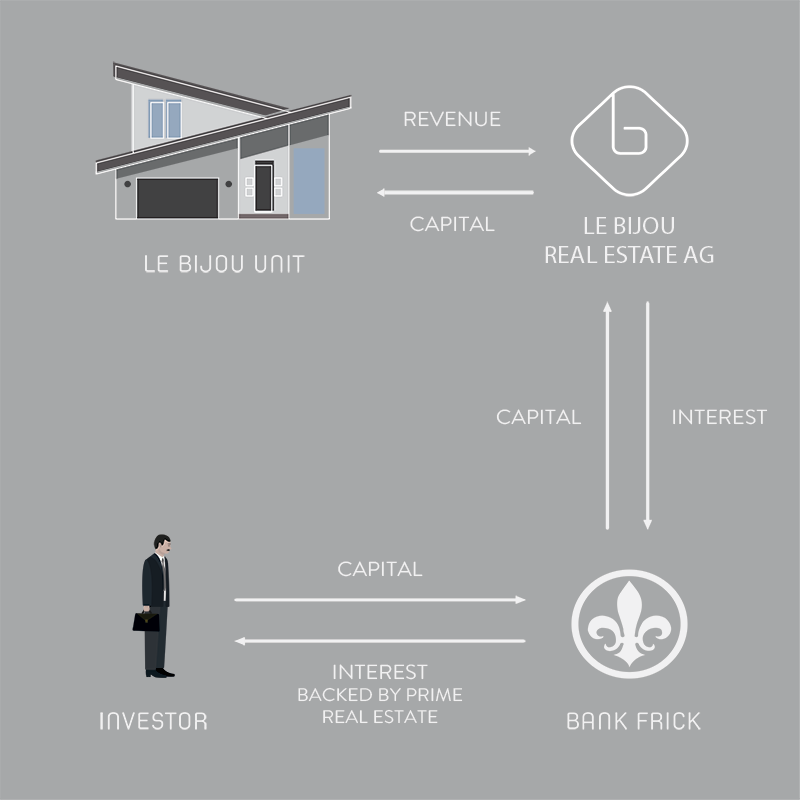

Those apartments are financed by a combination of Le Bijou’s own capital, private investors, and banks. Private investors can invest in bonds backed by real estate or in equity form by becoming a co-owner of a profit-generating Le Bijou franchise unit, to potentially receive correspondingly higher returns.

Bond – a type of investment in which the investor receives a guarantee for making a profit; a pledge secures this guarantee.

Equity – what a shareholder owns in a company, entitling him to part of that entity’s profits and a measure of control.

Buying bonds with Le Bijou means that the investor buys shares, giving them the opportunity to earn profit from the rental. The benefit of a bond is its guarantee of income. Those shares are secured by property that is rented, and if (in a case of force majeure) an investor doesn’t receive 3% fixed profit at the end of the indicated period, then the security will be sold and the invested money is returned to the bondholders.

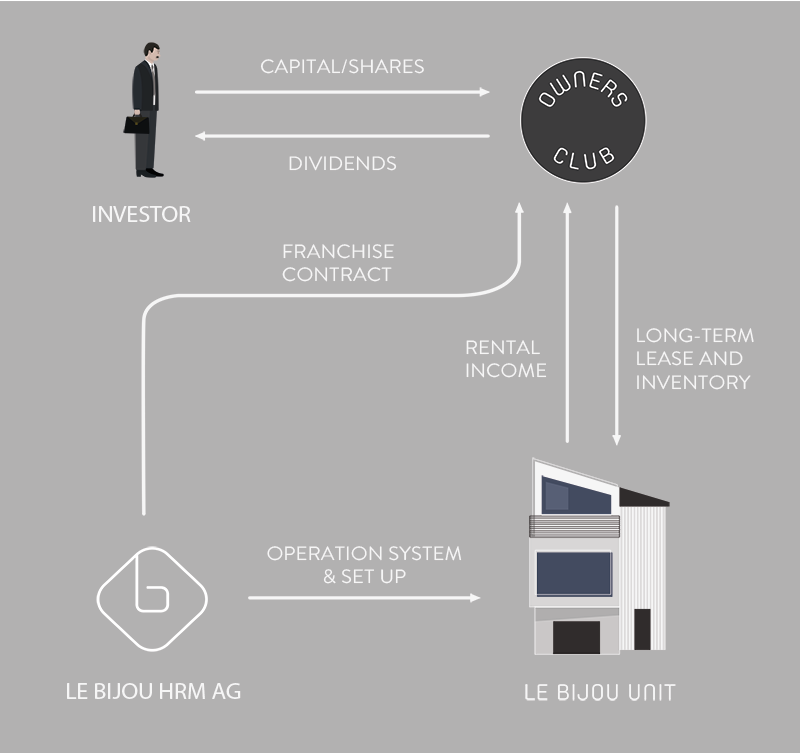

In the model with equity, Le Bijou franchise unit rents real estate for the long-term (up to 20 years), creates luxury interior designs and sets up the marketing channels for these apartments. The ownership of the renovation, lease agreement, and all the financial flows are transferred to a separate, newly created independent company (the Le Bijou Owners Club, an operational company that franchised the Le Bijou system) and the shares in that apartment are sold to a group of investors. These investors then would earn dividends – everything this apartment would earn minus operating expenses. In this embodiment, income is not fixed as in the case with bonds, but its earning potential is significantly higher and may reach 21% per year.

Le Bijou gains profit in the following ways: it retains 10% of property shares (to be able to participate in future discussions regarding the development of projects) and also receives a 20% fee from the revenue. This way, by holding 10% of the shares, we are even more incentivized in the success of the investments we manage: Le Bijou only receives dividends after the capital contribution has been paid.

A closer look at the investment model

What is the profit dependent on?

To understand what determines profit for investors, we should first understand who our customers are.

They can be divided into three groups:

- Tourists, local and international for both business and leisure

- Companies and business people who rent apartments for meetings and corporate events

- Agencies that rent apartments for private events

An obvious conclusion arises here: since tourists are not our only guests, we are less susceptible to seasonality than hotels, which in turn, makes our income more stable.

Often, our apartments are booked by event agencies who need a premium location for creating the right atmosphere. Therefore, our marketing strategy includes promotion among corresponding agencies.

Another advantage of this model is that the investors are not liable for their investments with their own assets, as is often the case when working with crowdfunding services. Most crowdfunding services use bank loans to leverage the purchase and the investors are liable for it with their own assets (i.e. house, cash, etc).

With Le Bijou, with the equity investment, you don’t own the property itself (we only lease it for 20 years), so you are indifferent to its price volatility. Moreover, there’s no bank leverage, so there’s no pledge involved. Therefore your shares and personal assets cannot be taken by a bank in any case.

With the Le Bijou real estate bond, you are still not liable for anything, as a bond is just a guarantee of the company to return your money back with interest.

Differences from other hotel investments

Most hotels have a common challenge – seasonality and the corresponding jumps and lags in business. In our case, this problem is solved through the Le Bijou diversified structure of demand (as described above) and by choosing locations in prime areas of major cities, where we can count on business visitors year round. Whereas a typical hotel is bound to renting the whole building, something that is rarely available in central areas, we can also work with small properties such as single apartments or former office buildings.

Managing a traditional hotel means one has to have a bigger overhead and hire full time employees. The need to pay salaries for hundreds of employees decreases the price flexibility, whereas with Le Bijou, we work with a carefully curated selection of independent contractors and carry almost no fixed monthly expenses. Fewer people, fewer worries, fewer risks all add up to a stronger type of investment.

Additionally, Le Bijou’s different investment models each have their own advantages over investments in the hotel industry.

Bond investment model advantages

- Your investments are secured by real estate and you receive a guaranteed income without the dependency on seasonality or managerial overhead.

Equity investment model advantages

- This type of investment is much less capital intensive, as we don’t buy the property – we just lease it. You do not carry the risks of owning the real estate and thus are indifferent to its price fluctuations

- Your investment is not leveraged by the bank. What that means is that ownership cannot be taken from you under any circumstances, which is always possible if a bank participates in the deal.

Differences from traditional real estate investment funds

The main distinctive features of investment funds (access to institutional investors and going through a fund manager) actually are the cause of its biggest weakness: they are spending a lot on expensive management teams and their overhead eats all the profits. Fund managers earn money all the time, while the investors’ profit varies.

Real estate funds usually have an appetite for large properties, so the cost of due-diligence (sometimes as high as a few hundred thousand USD) won’t be too high, relative to the cost of the building. This is a good approach for growing markets, where there are many new developments. But in mature markets, there is much more focus on the financial proposition than the demand for money, so multiple funds bid against each other for investment properties. The property owners increase the price and it draws the profits down. Where there is a lot of competition, there is little profit. The real opportunity lies in a mid-market segment, which is yet unavailable for retail investors but too small for institutional investors.

Not only do these types of funds miss the opportunity to work with smaller properties, but they are also inflexible and thus unable to nimbly work with short-term rentals, which provide the best returns.

Recently, the returns of real estate investment funds have not been great because profit is not guaranteed. Only 9 out of 141 listed funds at Swiss Fund Data yielded more than 3% in the last 12 months at the moment of writing of this article.

Our approach is radically different. We focus on properties in central areas of the biggest cities that a fund or even a hotel won’t consider because of their size, yet they are still not available for retail customers. We lease these properties at a discount, which the landlords are willing to provide because they trust our company. We then rent them out for short-term; it is a much more lucrative business model. We don’t have fixed commissions and our reward is proportional to investors’ earnings, so we don’t eat up the investor profit.

Bond investment model review

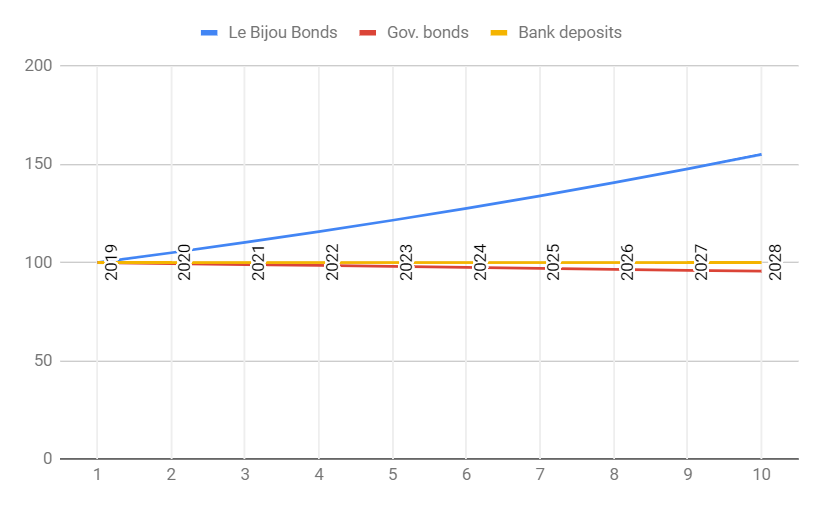

When investing in bonds, you not only get potentially higher returns than in most funds, but these returns are fixed – the amount of payments is guaranteed. Le Bijou bonds yield 3% – 5.2% fixed annual profit (dependent on the size of the investment).

Le Bijou Bonds Model Explained

Performance comparison of Le Bijou bonds, Government Bonds, and Bank Deposits. X axis: years, Y axis: worth of 100 CHF initial investment. Le Bijou bond yields 5.2% p.a., government bonds that yield -0.5% p.a. (at the moment of writing, bonds with different maturity yield from -1% to 0.5% p.a; source: Swiss National Bank), and bank deposits that yield 0% (most Swiss banks offer rates from -0.5% to 0.5% p.a.). We assume that all the profits are being reinvested.

Equity investment model review

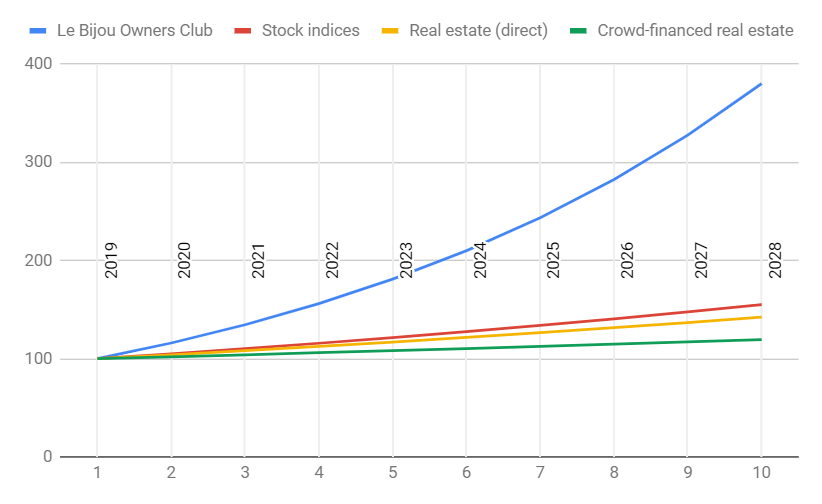

You do not risk having ownership of real estate, so you are indifferent to its price volatility; the investor doesn’t care, even if the market is at its peak. There is a massive difference in possible income: instead of 1-3% fixed profit, you may get up to 21% annually.

Le Bijou Owners Club Model Explained

Performance of the assets with flexible returns, if profits are reinvested each year

Performance of the assets with flexible returns, if profits are reinvested each year

X axis: years; Y axis: worth of the initial investment of 100 CHF, CHF

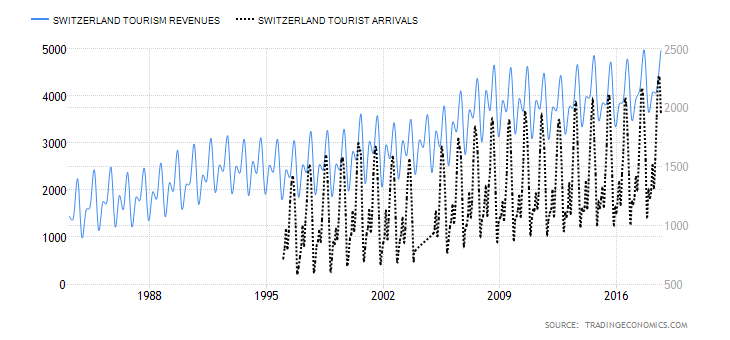

Switzerland’s tourism arrivals and revenues show a positive trend for the last 30 years, almost unaffected by global turbulence and crises. Quarterly revenues – CHF, mln (LHS); Tourist arrivals by quarter, thousand, (RHS). Source: Swiss National Bank, Tradingeconomics

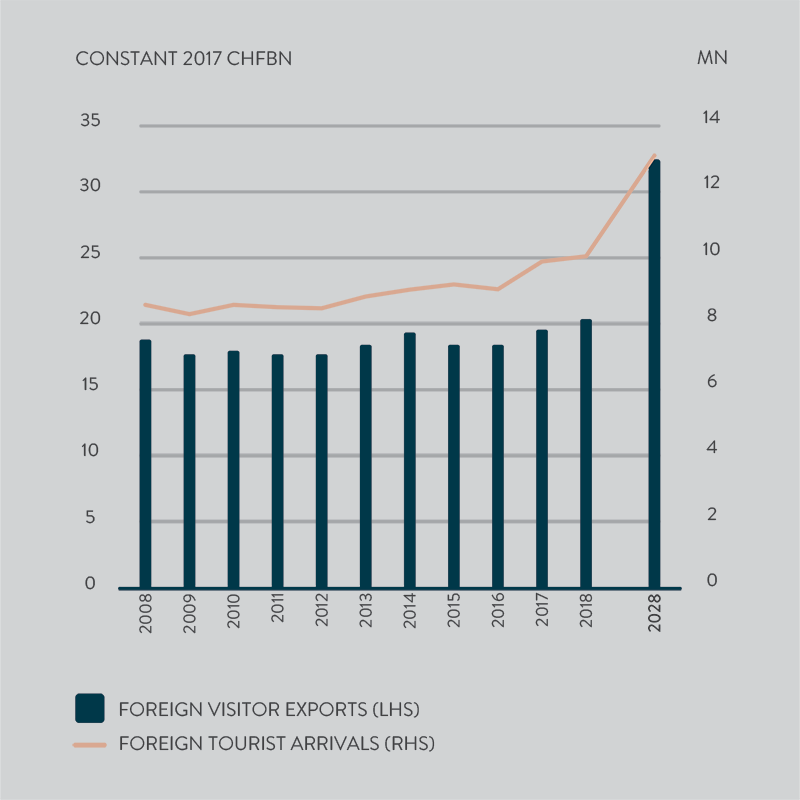

Switzerland: Visitor exports and international tourist arrivals expected growth

Source: World Travel & Tourism Council – report on Switzerland

What makes Le Bijou exceptional

It’s our experience that makes us indispensable. We have years of practice in accumulating contacts with realtors and owners of the best apartments in Zurich, Zug, Lucerne, Geneva, and other big cities. Apartment owners are pleased to cooperate with us because they know about our brand and know that we care about their property – after all, it’s our money invested in the high-end renovation, so it is in our best interest to keep it in the best shape possible.

We also have established contacts with event agencies in major Swiss cities and travel agencies from Saudi Arabia, Dubai, China, and Qatar, providing a more stable demand for our offerings.

Summarizing this section, the Le Bijou is a unique opportunity for all participants of this business. Owners have a brand to which they can trust their best apartments, agencies have a brand they can cooperate with in creating a proper atmosphere, and guests can just be delighted with the best hotel experience they have ever had.

Owners Club

All Le Bijou equity model investors automatically become members of the Owners Club. This is a unique feature that many of our customers appreciate. We created a club in which you can find like-minded people or even future business partners. The Owners Club meets at least a few times a year and is attended by existing investors – investment professionals, business owners, and celebrities, as well as select invited guests.

Investors also become brand ambassadors, and together with our guests create a new community of like-minded people that will accelerate the earnings above and beyond other hotel brands.

Last words

Potential investors may want to know about the level of satisfaction experienced by our guests. To that end, we provide testimonials from our consumers which have been published in the press and can be found here.

As an example of the positive feedback we’ve received from our valued customers, we’ve included the following comments below:

“Whether it’s a celebration with one or 100 guests, a business trip or a VIP stay, Le Bijou is an ideal location.” – National Geographic Traveler

“What Le Bijou has accomplished is to put all of the things that otherwise would be very complex for a traveler into a straightforward and elegant experience.” – John Sculley, ex-CEO of Apple and ex-CEO of Pepsi.

John Sculley, ex-CEO of Apple and Pepsi, about his stay at Le Bijou:

Additional reviews regarding our services can be found in the outlets where we promote our services, including Hotels.com, Airbnb and Trip Advisor.

It’s our hope that the idea of creating exclusive, private hotels inspires you as it has inspired us. We are confident that our investment vehicle is the right product at the right time, providing profit and security in an evolving market.