In the last article, we explored the various asset classes available to retail investors in today’s climate. We ended on a note that bonds, especially ones backed by an income-generating asset, strike a good balance between capital security and real return.

Today, we will dive deeper into the bond world and explore what makes bonds so attractive and what types of bonds investors should be aiming for when searching. After all, the US bond market alone larger than the entire global equity market capitalisation combined, therefore it is crucial to pick the appropriate instrument that fits your personal risk profile.

What is a bond?

Bond is derived from the English word “to bind”, which creates a binding instrument for one party to pay another. In the modern financial world, a bond represents an obligation for the borrower to pay the lender under terms stipulated on the bond instrument.

To retail investors, their most direct encounter with bonds probably lies with the mortgage on their houses. In this case, banks lend homeowners a fixed amount at an agreed interest rate to purchase the house. In return, homeowners repay a certain percentage of the loan (plus interest) every month for the duration of the mortgage.

Why do bonds exist?

The distinct advantage when buying an asset using capital (cash) derived from bond issuance is that the borrower retains 100% ownership (equity) of the asset. Imagine instead of issuing you with a mortgage in the house purchase, banks offered you equity investment. It will mean that part of the house will be legally owned by the bank.

What a messy world it becomes!

By using borrowing, it simply means that as long as the borrowers keep up with the obligations outlined in the bond (usually the monthly payment), ownership of the asset remains 100% with the borrower.

Bond is a type of financial leverage that enables investors to punch above their weight and buy assets that were previously out of their reach. It is fundamental to the health of our economies and that’s why there exists a multi-trillion market for it.

Why invest in bonds?

Bonds offer return on capital in the form of interest (coupon) payment at a rate stipulated in the issuing instrument. It is fixed and it rarely changes. This makes it an attractive option for investors who seek regular income streams at predictable intervals. In fact, bonds are often called “fixed income instruments” in the financial world.

Bond return is judged on a concept called yield, which is a glorified way of saying interest rate.

Yield (expressed in %) = Total annualised income / Total capital invested

Logically the higher the yield, the more income is generated and naturally the greater the return on capital.

Bondholders usually would continue receiving coupon payments for the duration of the bond holding period. In the end, however, capital is returned to investors in its entirety, without deduction or addition.

Furthermore, bondholders enjoy liquidation preference over equity owners, which means that in the event of bankruptcy, all assets of the company will be sold (liquidated) and the proceeds will be used to redeem bondholders first. Any residuals can then be reimbursed back to equity holders.

Bondholders can even demand an even greater level of capital protection through collateralisation, in the form of secured bonds. In this instance, there is a designated asset (e.g. a house) that serves as security for the debt. Any default events will see bondholders seizing the asset for liquidation and capital recuperation.

This is the central feature of bond: in exchange for capital security, the capital does not appreciate and all returns are earned in the form of coupon payments.

Types of bonds

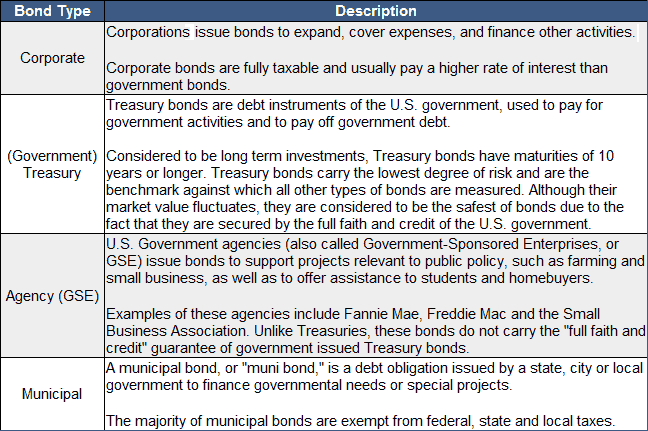

There are several different approaches to classify bonds. Typically they are broken down by the institution that issues them (issuer).

Source: InvestingAnswers

How bonds behave on open markets?

Given the size of the bond market and its numerous participants, it is important to understand how bonds behave.

Bond investors really only worry about 2 things:

- Capital security: am I going to get my money back at the end?

- Return on capital: am I achieving the best yield?

These 2 factors are intricately linked.

Assuming an investor buys a sovereign bond issued by a reputable government (e.g. US Treasury Bills, UK Gilts or Swiss Government Bonds) with a AAA credit rating at par value (i.e. the nominal face value on the bond instrument), it is extremely unlikely for the issuer to default and as a result, the capital security of these bonds is guaranteed. Consequently, the coupon rate (i.e. yield) on these bonds tend to be lower (sub 2% per annum), in order to reflect the decreased risk level borne by the investors.

However, most investors do not buy bonds at par value (i.e. on issuance), but in secondary markets where these instruments are actively traded every day. Here a third factor comes into play and that is the base rate.

Imagine a 20-year term bond has just been issued at 3% coupon with a par value of $100, whereas the base interest rate at the central bank stands at 1%. That means that investors will receive $2 more per year by investing in the bond versus holding the cash as bank deposits. As these 2 assets are perceived to both offer risk-free return, investors would rather park their capital in the bond than the bank deposit, in order to enjoy the superior return.

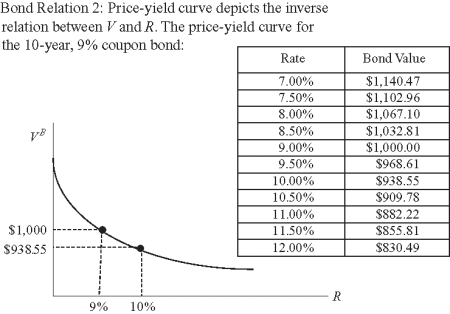

As demand for the bond begins to outstrip supply on secondary markets (remember the par value will always remain unchanged at $100), the cost of acquiring the bond begins to increase and it can exceed the par value. This is because investors expect the bond return will outstrip deposit return over the long-run, thus delivering better relative value. As a result, they do not mind paying slightly more upfront. The increase in bond price would push down the yield because the absolute income level generated remains unchanged.

Now imagine that the central bank decided to raise the base rate to 4%. Now suddenly bank deposit would generate $1 extra per year over the bond. This instantly decreases the attractiveness of the bond and would cause capital outflow from the bond into the deposit. This decrease in demand pushes down the bond price, which then causes the yield to increase. This, in turn, restored the price equilibrium.

As a result, in addition to capital security and yield, bond price on the secondary market is also intricately linked with the future expectation of central bank interest rates. The greater the expected difference, the greater the bond price movement.

Bond price tends to move in opposite direction to interest rate

Source: Fidelity

What happens when bonds default?

In life, the unexpected will happen and it always helps to be prepared. When borrowers (bond issuer) fail to adhere to the terms of the bond (usually paying on time), they default. There have been some high profile default events over the past few years:

- 2001 Argentina sovereign debt default

- 2013 Detroit bankruptcy

- 2008 Lehman Brothers bankruptcy and subsequent debt default

During a default, bondholders (creditors), given their liquidation preference, have the option to apply for court orders to legally liquidate all assets owned by borrowers and attempt to recoup their capital and accrued interest.

However, this may not always be the optimal route when the current assets of the borrower are less than the amount owed. This is especially the case if the borrower is an actively trading business that is generating consistent cash flow. Under these scenarios, it is in the overwhelming interest of both bondholders and shareholders to see the business continue trading rather than having all of its assets immediately seized and liquidated. This way, bondholders can use its cash flow to redeem the outstanding loan whilst shareholders’ equity value is preserved.

In such instance, a process called debt restructuring may occur where the original terms of the debt are modified into more favourable ones that are mutually acceptable by both bond and shareholders. This maintains shareholders’ control of the business whilst ensuring bondholders continue to receive their coupon and capital payments. Debt structuring can only be used by borrowers with consistent cash flow and ideally valuable assets (e.g. properties, machinery) that may serve as collaterals.

Property-backed bonds offer a unique combination

From the information detailed above, it is evident that the key features of an attractive bond are:

- Higher yield relative to its peers and the central bank rate

- Collateralisation against valuable and marketable assets

- Borrowers’ ability to generate regular cash flow

As a result, rental properties offer a natural habour for bond investors.

Rental properties can be bought by a limited company (a special purpose vehicle or SPV), which in turn issue bond instruments to fund the purchase. The SPV then uses rental income from the property to make coupon (or a mix of coupon and capital) payments to its bondholders. Given that bondholders can hold the first charge in the title against the property, it means that in the event of default and the property is sold off, bond investors will be first in line for the payout. This significantly reduces risk exposure.

There are 2 conditions when assessing RE-backed bonds:

- Underlying rental yield: this must be higher than the coupon rate of the bond as otherwise, coupon payment will become unsustainable;

- Loan-to-value (LTV) ratio: this is a measure of indebtedness similar to the debt-to-equity ratio in companies. A 60% LTV ratio means the total outstanding loan on the property represents 60% of the current property value. Put it another way, given that bondholders hold the first charge, the property value will have to fall by more than 40% from its current level for bondholders to start losing their capital, should a liquidation occur today. As a result, the lower the LTV, the greater the capital security.

How does it compare to other bonds?

| Type | Example | Grade | Yield to maturity | Capital fluctuation | Default recovery |

| RE-backed bonds | LB bonds | Ungraded | 5.2% | None | Backed by properties as collateral |

| US Municipal | California Affordable Housing Agency Bond | Ungraded | 4.4% | -2.5% since the commencement of trading | Not backed by any assets but instead the municipality’s taxing power |

| UK Gilt | UK 10-year Gilft | Aa2 Stable | 1.2% | Trading at 25% above par value currently | Unlikely as the UK has never defaulted and enjoys the highest credit rating |

| Swiss Corporate | Credit Suisse Group Funding | Baa2 (Investment Grade Medium) | 0.54% | Trading at 1% above par value currently | Not secured against company assets but creditors may make claims against them through court if default occurs. |

As one can see from the table above, RE-backed bonds enjoy a unique combination of:

- High yield to maturity;

- No risk of capital fluctuation due to it not being publicly traded;

- Ease of capital recovery during default rather than having to go through an onerous bankruptcy process;

- Capital recoverability during default is more certain given that most LTV do not exceed 60%, whereas other bonds do not enjoy such benefit.

In conclusion

Bond investing occupies a happy intermediate between capital security and real return on the capital. When secured against income-generating real estate assets, its return profile can significantly exceed the risks entailed, thereby making it an attractive investment choice.