During the Age of Discovery when European navies sailed the Atlantic to unearth the treasures of the New World, explorers would often be motivated by patriotism, or pure curiosity, or for others simply showing loyalty to the crown. But above all, the X factor for most of these globetrotting traders was to acquire fabulous wealth.

Nearly all of these extremely expensive expeditions were privately funded and investors expected a very good financial return indeed. Everyone knew the risks were high and there was a strong chance the sailors might never return to home port. A shipwrecked crew would mean empty pockets for gambling investors but many were handsomely rewarded by making a calculated gamble . In fact, could these medieval moneymen, who hoped for exotic booty or valuable raw commodities in return for the big piles of cash required to fund expensive expeditions to the Americas, represent the first ever example of crowdfunding?

Of course they didn’t call it crowdfunding and it wasn’t invented by Columbus but modern crowdfunding has its roots in medieval trade. Such social creatures like humans have long realised that the power of an individual is best found harnessing collective brainpower and of course the cash, to get things rolling. In a nutshell then, Crowdfunding allows investors to pool resources and to achieve common objectives, that might otherwise be impossible.

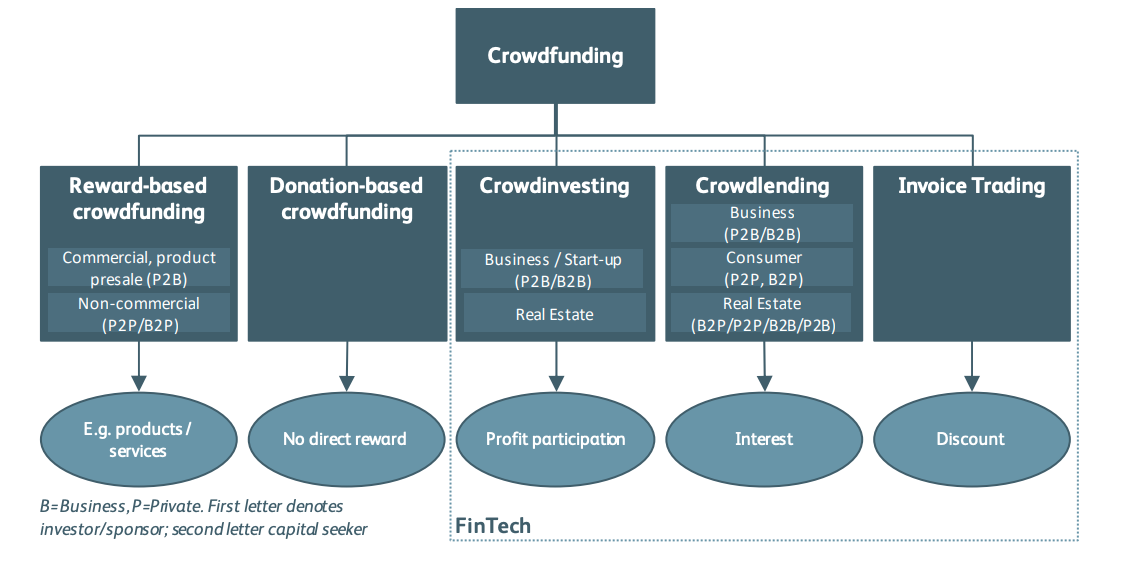

How many types of crowdfunding are out there?

These days there are loads of crowdfunding platforms, and they come in a whole variety of different shapes, colours and sizes. But which one is best suited for your purpose and profile?

Swiss Crowdfunding Platforms Classification

Reward-based crowdfunding

This type of funding is often used by inventors and innovators to initiate their dream project. By creating an online pitch, investors (or contributors) pledge a certain amount of one-off funding. Once a threshold is reached, the capital is released to the investor to realise his vision.

Such crowdfunding often has little commercial motivation as contributors often invest purely for the joy of supporting someone or an idea they have a personal affection for. Usually, however, inventors will reward contributors with something tangible, for example, invitations to events, special editions or pre-release access to a product.

Examples: 100-days, Causedirect, fundeego, Funders, Kickstarter

Donation-based crowdfunding

Donation-based crowd giving or donation-based crowdfunding raises money in the same way as charities. They are reliant on small donations from thousands of generous individuals who are sold on the idea and don’t expect much if anything in return. Such platforms enable individuals with a good cause or idea to launch online campaigns that might raise even more funds. The success of the campaign depends entirely on its reach and the quality of the donor base. In effect, this type of funding can turn an individual into a charity and even make a life-changing impact on the beneficiaries.

Examples: Progettiamo, SIG Impact, ProjektStarter

Crowdinvesting

This concept transcends industries and can be suitable for investing in philanthropic projects. It may also be particularly suitable for startup businesses that would otherwise struggle to secure crucial launch funds. In return, investors receive shares in the business that entitles them to future profits and growth potentials. Normally these shares have a different class to the normal ones which have more restricted voting powers.

Funnily enough real estate crowd investing is now operateing on a similar principle, albeit with more rigid security, lower risk thanks to the dependable value of premium property in the most developed markets of Europe. Here, investors become co-owners of a property and are entitled to a full-range of associated benefits. Usually that’s the rental income and capital appreciation.

Company crowd investing examples: Beedoo, c-crowd, Crowdpark, investiere, Raizers

Real estate crowd investing examples: Crowdhouse, Crowdli, Foxstone, Yeldo

Crowdlending

Businesses may also use loans instead of equity investment (due to the former being a cheaper source of funding) to fund their operations. However not every business fits the lending criteria of commercial banks and thus a significant minority of companies find themselves shut out of traditional financing. But crowdfunding platforms aim to match investors to suitable projects that are searching for capital, usually for a relatively high-interest rate. Even though the power of an individual investor may be limited, the cumulative effect of hundreds of backers can solve the funding requirement of many cash-flow starved young businesses.

Example: 3Circlefunding, Cashare, Acredius, Creditfolio, CreditGate24.

Invoice financing/factoring

Although a relatively novel and niche product to the consumer market, invoicing financing as a product has essentially existed for thousands of years. The principle is quite simple: companies need cash and invoices are instruments to cash. However, invoices tend to have credit terms (usually 30 days, some may be more) and credit risks (failure to pay) associated with them. So a while back, some genius set up a business to pre-pay companies their invoices (at a discount) and also assumed the role of chasing these debts themselves.

The benefit to businesses is an immediate cash injection, to supply much-needed working capital or steady cash flow. The drawback is that these invoices are paid at a discount, therefore net revenue will be impacted.

Historically this was the realm of qualified financial institutions, but in recent years this segment has opened to retail investors. Now individuals can form groups (through platforms) and assume ownership of such invoices. In exchange, they will receive the difference in the invoiced amount and the amount paid to businesses.

Example: Advanon

Crowdfunding platforms in Switzerland

Check the tables below for our new 2020 audit of the biggest and best crowdfunding platforms in Switzerland.

| Name | Category | Established | Payment model | Fee information |

| Beedoo | Business crowd-investing | 2017 | All-or-nothing (must hit a funding threshold) | Investee: 10% of the capital raised

Investor: 7.5% of the capital gains once liquidated |

| c-crowd | Business crowd-investing | 2011 | All-or-nothing (must hit a funding threshold) | Investee: 10% of the capital raised

Investor: 5% of the capital committed |

| Investiere | Business crowd-investing | 2010 | All-or-nothing (must hit a funding threshold) | Investee: no fees

Investor: 3-6% initial fees + 15% carried interest at a CAGR of 5% |

| Crowdhouse | Real estate crowd-investing | 2015 | All-or-nothing (must hit a funding threshold) | Initial fees: 3% of the property purchase price

Annual management charge: 5% of the net rent |

| Crowdpark | Real estate crowd-investing | 2018 | All-or-nothing (must hit a funding threshold) | Initial fees: 3% of the property purchase price

Annual management charge: 5% of the net rent |

| Foxstone | Real estate crowd-investing | 2017 | All-or-nothing (must hit a funding threshold) | Initial fees: 3% of the property purchase price

Annual management charge: 0.5-1% of the net rent |

| Advanon | Invoice factoring | 2014 | All-or-nothing (must hit a funding threshold) | Unclear, although investees are expected to take a 15-20% discount on their invoices to secure factoring. |

| Kickstarter | Reward-based | 2009 | All-or-nothing (must hit a funding threshold) | 8-10% levied on the raiser |

| Funders | Reward-based | 2016 | All-or-nothing (must hit a funding threshold) | 7% of the total amount raised |

| SIG Impact | Donation-based | 2018 | All-or-nothing (must hit a funding threshold) | 10% of the project sum if not a member of GIS; otherwise no fees |

Crowdfunding for new crowdfunding investors: know the pros and cons

Modern Crowdfunding platforms have brought refreshing new opportunities for investors looking for something a bit different. Sure they can be personally rewarding and they might sometimes even turn a profit, but they are quite risky. So before throwing your hat in the ring make sure you take a long hard look at any potentially hidden liabilities. And don’t forget to analyse these key features:

- Broadened accessibility: previously many of the opportunities (e.g. investing/lending to small businesses) were simply inaccessible to most retail investors. They were reserved for either institutions or the ultra-high-net-worth individuals. These platforms opened the niche and formed a new asset class for ordinary investors to benefit.

- Safety and trust: the key role of these platforms is one of safety and trust. They also screen and inspect prospective companies to ensure the funding requirement has a genuine commercial basis. Furthermore, they hold investors’ capital in escrow until all the requirements of the campaign have been met before releasing them to the investee companies. As a result, virtually no investors have lost money due to fraud in the investment process (even though plenty have done so due to business failure of crowdfunded companies).

- Time-saving: this can be reflected in both accessibility and trust. From an asset selection point of view, instead of spending time hunting for niche opportunities, crowdfunding platforms present all of them in a uniform manner for investors to choose. From a safety and trust point, rather than doling out expensive fees to lawyers and accountants, these platforms have performed the pre-screening required to ensure the genuineness of such businesses. This makes investors’ lives easier.

Of course, crowdfunding platforms are not a magical unicorn that will instantly make you wealthy. In fact, they are full of potential pitfalls and drawbacks.

- Risk of permanent capital loss (for investments not backed by real estate or similar securities): most businesses that fundraise on these platforms are there for a reason. Usually because they could not convince traditional financial institutions to lend. As a result, these businesses carry inherently high levels of risk and are more vulnerable to failure. Consequently, investors are more likely to see permanent capital loss than other asset classes.

- Platform fees: crowdfunding platforms earn revenue by charging a commission to companies based on the capital raised, usually 3-8%. Although this does not impact investors directly, the indirect impact remains. Assuming a commission rate of 5%, it means that only 95% of the invested equity capital is actually deployed into the investee company and thus the valuation of the company is immediately reduced by 5%, thus decreasing the value of each share held by investors.

- Poor regulation: crowdfunding is still relatively unregulated but because of its increasing popularity, the Swiss financial regulatory authority FINMA is preparing new legislation. Meanwhile there are plenty of loopholes to keep an eye out for. For instance, some platforms registered abroad may not be subject to Swiss banking regulations and yet they may still accept investment from Swiss-based individuals. If the platform features wannabe entrepreneurs who appear a little inexperienced or overconfident, it is strongly advisable to focus on due diligence procedures, in order to mitigate increased exposure to risk.

- Cooperation issues: with crowdfunding, you can only make decisions in a democratic way, synchronized with other investors. If you have dozens of other investors on board, decision-making can be hard. Even gathering all the investors around a table might become a challenge. Hardest is finding a rigid consensus. So be prepared to keep your cool and be patient and willing to pool authority and sacrifice legal controls you’d normally demand at this price point. Above all, make sure your agreements are not rushed. They need to be as watertight as possible. The general rule of thumb is, “the more parties involved, the harder it is to agree on decisions”. A crowd is a crowd. Before you invest through a platform, double check you know the conflict-resolution algorithm and are properly aware of all your legal rights.

- Liquidity. Most platforms have very limited liquidity and offer no buy-back option. It means that you could end up holding a small share of a business or property that you can’t sell.

How does crowdfunding stack up against alternative investment options?

Don’t forget, when assessing the potential of any investment, risk-reward profiles are essential instruments that allow you to make carefully calibrated decisions, since they reveal the underlying opportunity cost. Here’s a list of alternative assets with basic risk-reward profiles included (from one of our previous analyses).

| Asset class | Returns | Risks |

| Swiss bonds | -0.8% to 0.7% (2018) for different bond types; real estate bonds yield up to 3%, and corporate bonds up to 5.5% | Bonds are widely considered the safest investment option. |

| Swiss stocks | Vary widely; Swiss index funds (close to “average” market returns) show between 0.37% and 1.32% annual returns. | Picking individual stocks not recommended for non-professional traders. |

| Hedge funds | Vary widely, not predictable. | Not recommended as the performance of most funds is worse than the average market performance over the long run. |

| Direct real estate investments in Switzerland | 2% to 4% p.a. for mid-market; 10% and higher for luxury properties | The demand can be dependent on nearby factories and offices of big companies; management costs may be high. |

| Bank deposits in Switzerland | -0.5% to 0.5% p.a. | Negative real return |

| Robo advisors | Vary widely, not predictable. | Specific to the platform and approach, although most of them invest in ETFs and bear significant risks. |

| Wealth Management: top family & multifamily offices in Switzerland | N/A, as usually wealth management companies create custom portfolios for investors that consist of other instruments, covered or not covered in this article. | Bad management and/or wrong incentives of the manager. |

| Investing in Gold in Switzerland | N/A, as the only returns that can be made come from the changes in gold’s price, which is unpredictable. | The price is unpredictable; gold does not generate an income. |

We shall consider only crowdinvesting and crowdlending platforms from an investment return point of view because both reward and donation-based ones are not comparable. We have discovered that:

- Crowdlending returns average 4-8% per annum, depending on the business investment and the risk level. Obviously higher risks are usually associated with greater returns.

- Crowd-investing startup businesses do not have sufficient data to indicate their return profile. This is due to the infancy of the industry. It is perhaps telling that the illiquid and opaque nature of such assets may already be a consideration of investors. Additionally, most new businesses fail within their first 5 years, thus as a result, these assets are highly risky.

- Real estate crowd investing delivers an average return of 3-7% per year, whilst also being securitised by tangible underlying assets that are likely to retain value even cyclical bouts of economic turmoil. In the event of financial distress or default, investors can legally seize the property and liquidate on the open market, for a worthy and efficient way of recovering capital fast.

Building an investment portfolio to stand out from the crowd

Being a new asset class, crowdfunding brings in exciting and challenging opportunities for investors. When in luck crowdfunding can a thrilling social adventure that will make you feel richly rewarded, although perhaps not in a financial sense. But beware of the numerous hidden dangers lurking in modern crowdfunding as well as the higher risks of investing in a business with little or no financial track record. And remember, crowdfunded startups usually lack those data-rich risk-reward profiles that make investment decisions relatively straightforward. Basically, be completely prepared to lose all that cash. If you can afford to gamble and have some fun, especially if you want to engage in philanthropy for example, then this is one of those leaps of faith into the darkness that you definitely shouldn’t be afraid of committing to.

So all you investors thinking of jumping on the crowdfunding bandwagon, take a close look at all the many options and variations. And do so with caution. You might strike it lucky but you would be wise to pause for thought before letting go of significant funds. On the other hand, while real estate crowdfunding might not be the cure-all panacea, it features bankable security features and the reassurance that you’ve a tangible, traditional asset with a straightforward mechanism for extracting collateral when required. Such hidden gems are not always easy to get hold of, at least at the moment, but when they are on offer, they possibly represent the bang-for-buck, especially in such economic turbulent times.