How the rise of robo-advisors is transforming the investment world

Back in the 1950s when computers were first applied to modern finance, investment professionals were scornful of the thought that computers might one day be taking all their jobs.

But they couldn’t have been more wrong. Today, the global robo-advisor industry has ballooned into a 5-trillion dollar juggernaut, managing the savings of millions of investors. So what are robo-advisors and are they really worth the effort?

The defining features of the robo-advisor

Essentially, robo-advisors replace traditional investment managers by making asset selection and allocation decisions themselves.

They are digital platforms that provide automated, algorithmic-driven financial planning services without human intervention.

The crunched data derives from a standardised risk and behavioral questionnaire completed by investors.

Robo-advisors removed the financial barriers that had been holding back first-time investors and high-net-worth-individuals (HWNI), from obtaining professional portfolio management services at affordable rates.

Traditional investment managers perform two core functions:

- Construct a suitable portfolio based on individual investors’ risk tolerance and personal preference

- Rebalance the relevant portfolio periodically to ensure it remains aligned to the said objectives

With the advancement of computing power and hyper-connectivity, specialised automated portfolio allocation software could perform these two core tasks faster and more accurately than a human, at a fraction of the cost.

Suddenly, the biggest cost factor in investment management, namely the salary of the investment manager, all but disappeared.

The rise of the robo-advisors means you no longer have to be exceptionally wealthy to afford portfolio management services. $1000 is already enough to enter the fray. The trouble is, the vast majority of robo-advisors buy assets that are invariably overpriced.

How do robo-advisors work?

The robo-advisor journey contains three distinct phases:

- Understand customer

The relevant platform will ask prospective investors a series of questions in order to estimate their individual risk tolerance and investment preference (e.g. socially responsible investing). - Construct portfolio

Based on the outcome of the questionnaire, the platform will offer investors a list of pre-constructed portfolios that best match their risk levels and preferences. These portfolios tend to be populated by exchange-traded funds (ETFs), which together form a diversified group of assets. - Execute, monitor, rebalance

Once investors have selected a portfolio, the platform will execute the trade and continuously monitor its composition to ensure it remains suitable to the stated objective. Should any deviation occur, it can automatically rebalance without much intervention.

Here are some of the world’s leading robo-advisor platforms

Wealthfront

Quick Facts

Key operating principles: long-term passive investing in ETFs based on a pre-selected risk questionnaire

Assets invested: Index ETFs

Fees: 0.25% per year on the portfolio balance

Minimum balance: $500

Sign-up promotions: first $5,000 is managed free of charge

Wealthfront is a high-end, consistently reliable robo-advisor, described by NerdWallet as an emerging and well-rounded fintech service provider.

Its long-term index ETF-based investment philosophy is easy to understand and cheap to execute.

It also integrates some novel technology such as automated tax-loss harvesting, to help enhance overall investor returns.

Furthermore, it offers margin loans to investors by using their portfolio as collateral.

Betterment

Quick Facts

Key operating principles: long-term passive investing in ETFs based on a pre-selected risk questionnaire

Assets invested: Index ETFs

Fees: 0.25% per year on the portfolio balance

Minimum balance: $0

Sign-up promotions: fee-free management period up to 1 year based on the initial investment amount, starting from $15,000

Betterment provides a similar service to Wealthfront, which is to create a portfolio personalised to the investor’s individual risk tolerance.

It also invests in index ETFs, which aim to passively perform in-line with the general market. It also offers thematic investment options such as socially responsible investing.

Unlike Wealthfront, it does not offer any margin loans.

Ellevest

Quick Facts

Key operating principles: long-term passive investing in ETFs based on a lifestyle and life goal questionnaire

Assets invested: Index ETFs

Fees: 0.25% per year on the portfolio balance

Minimum balance: $0

Sign-up promotions: Up to $750 cash bonus with a qualifying deposit

Ellevest is a robo-advisor platform designed especially (but not exclusively) for women. Despite investing in similar ETF assets as other robo-advisors, it has adopted a different approach, by focusing on the gender pay gap and the difference in risk tolerance and long-term life outlook.

Ellevest also deploys a special lifestyle questionnaire in order to better understand the investors’ requirements, and identify appropriate portfolio recommendations.

Overview of the Top-3 Swiss robo-advisors

TrueWealth

Quick Facts

Key operating principles: long-term passive investing in ETFs based on a simple risk gauge

Assets invested: Index ETFs (mostly Swiss, European and US equities)

Fees: 0.5% management fee plus 0.2% fund expenses per year (0.7% total expense ratio)

Minimum balance: CHF 8,500

Sign-up promotions: None

TrueWealth is a Swiss-based robo-advisor catering specifically for the domestic market. It aims to offer passive wealth management at an affordable cost, thus it mainly serves the mass affluent market.

The overall philosophy is similar to many of the other global robo platforms, who all believe that most investors are simply not equipped to beat the market. And that time spent passively in the market is far more important than trying to time the market.

Selma Finance

Quick Facts

Key operating principles: long-term passive investing in ETFs based on a chatbot financial review sessions

Assets invested: Index ETFs (mostly Swiss, European and US equities)

Fees: 0.68% management fee plus 0.22% fund expenses per year (0.9% total expense ratio)

Minimum balance: CHF 2,000

Sign-up promotions: None

Selma Finance is another Swiss robo-advisor platform serving the Swiss and Finnish markets. It uses a chatbot which gathers all of your financial information, aspirations and attitudes to risks, before presenting you with a personalised ETF portfolio.

It comes wrapped under a beautiful and minimalistic user interface. Unsurprisingly, its portfolios are especially rich in Swiss-based assets. The fees are pitched towards the higher-end of the market.

Swissquote

Quick Facts

Key operating principles: long-term passive investing in ETFs based on a simple risk definition

Assets invested: Index ETFs (mostly Swiss, European and US equities)

Fees: a tiered fee structure with a TER in excess of 1%. Details are here.

Minimum balance: CHF 10,000

Sign-up promotions: None

The Swissquote Robo-Advisory Platform is a new service offered by Swissquote, a public Swiss banking group. It asks investors to identify their risk tolerance level (from 1 to 10) and then make an ETF-based portfolio recommendation based on that.

In our opinion, with a straightforward approach, a corporate-style user interface and the above-average fee structure, this is a safe bet for more traditional clients.

Tips on choosing the right robo-advisor platform

With a plethora of robo-advisor platforms available to investors today, it can be difficult to choose the right one. However, with a few simple tips, it need not be a difficult task.

- Total expense ratio – numerous researches have demonstrated that fees are the single biggest drag factor to portfolio performance. As a result, it is important to keep it to a minimum.

- Investment philosophy – most platforms offer a passive index tracking approach based on the use of ETFs. In the next section we will consider why this has a fundamental flaw.

- Rebalancing and other special features – every portfolio will inevitably deviate from the objective as time passes and it is important to rebalance to restore the equilibrium. Consequently, investors need to know the frequency and method of rebalancing as well as any other useful features offered by the platform (e.g. tax loss harvesting).

- Account type – the effect of tax on a portfolio can be very taxing, to say the least. That is why it is vital to be as tax efficient as possible and some account types (e.g. retirement savings) are more so than others. It is important to ensure the platform offers the account type you desire.

- Customer service – whilst robo-advisor platforms are designed to be technology-driven and require minimal human intervention, it is important to know the type and quality of customer service support when things do go wrong.

What could possibly go wrong with robo-advisors?

There are advantages in robo-advisor platforms and they are steadily serving the needs of a previously untapped market segment. They are the mass affluent investors that traditional wealth managers had always rejected.

Robo-advisors provided an easy and affordable entry into the world of discretionary investment management.

However, robo-advisors are not without their limitations. In fact, there are several critical flaws which make them ill-suited for investors who are serious about their long-term wealth:

- Lack of outperformance: the underlying premise of most of these platforms is that the market is efficient and information is symmetrical, therefore rather than trying to outperform, it is far cheaper to just buy indices and maintain benchmark performance with the rest of the market in the long-run. However, it has been shown that a selected group of elite capital allocators (e.g. Warren Buffett and Berkshire Hathaway) can produce superior returns consistently and investors would be better off by sticking with them. With some robo-advisors, it seems you just end up buying market indices and paying an additional fee.

- Lack of diversification: all of the platforms we reviewed invest heavily in ETFs, which incorporate a basket of stocks. However, most ETFs replicate an index via the Market Weight methodology rather than Equal Weight. This results in companies with a high market cap occupying a disproportionately large slice of the portfolio (in many ETFs, the top 10 holdings occupy over 60% of the portfolio) and thus the perceived diversification is in fact the absence of it.

- Concentration of capital: due to the surge in the popularity of ETFs over the last decade (partially fuelled by the rise of robo-advisor platforms), trillions of dollars has been poured into ETFs. Thus significantly inflating their valuation and decreasing the margin of safety.

While the first issue is clear to most investors, the others are largely ignored by the market.

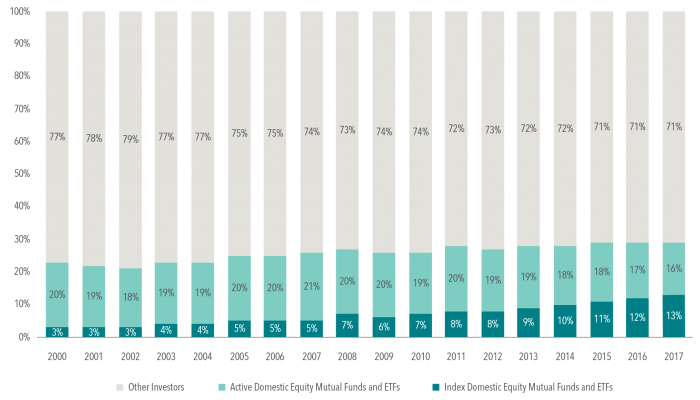

Index funds investing has been going strong for over two decades – on the diagram below you can see that an increasing amount of stocks are owned by index funds:

Investor Breakdown in the US Stock Market as a Percentage of Total US Stock Market Capitalisation

The ins and outs of index funds

Basically, index funds invest money without basic price discovery. It means that stocks and bonds are being purchased based on the underlying value of the company.

In other words, index funds buy securities at the price the market dictates, unlike Mr. Market, who is notorious for making more impulsive moves in market-weighted indices, that often contribute to potentially disastrous market bubbles.

For Switzerland, the situation is even more worrying. Not only index funds own large portions of shares, but with a quick analysis we found that the largest Swiss ETF holds 43% of its worth in just 3 shares.

Read our more detailed analysis of Swiss ETFs here.

“The largest Swiss ETF holds 43% of its worth in just 3 shares.”

None of the reviewed robo advisors do the “advisory” part, instead they just purchase ETFs and this leads to buying securities with high correlation with the markets. Thus the “added value” of robo advisors has nothing to do with “robotics” or “machine learning”, and in essence is just brokerage, not advisory.

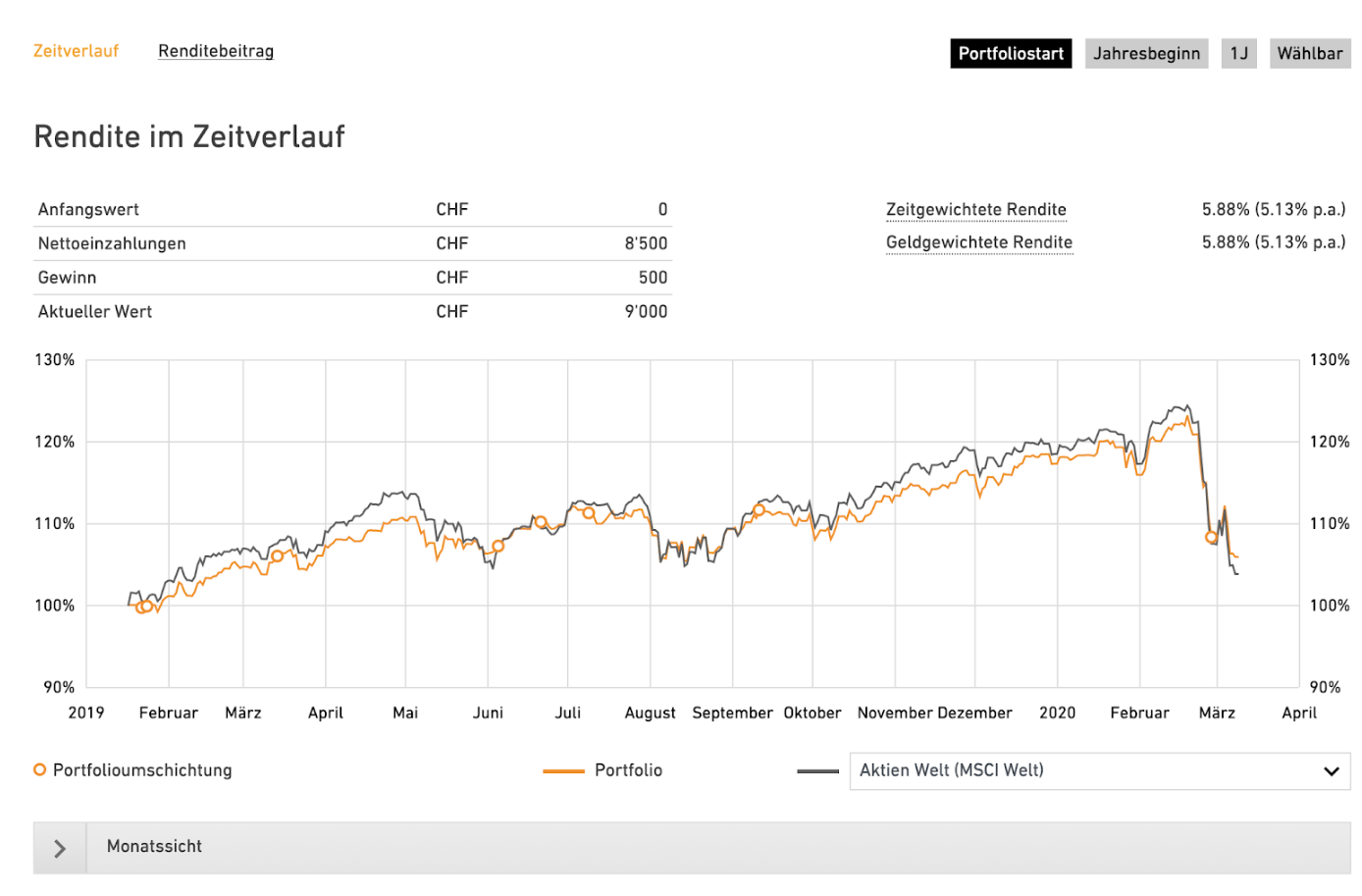

As an example, you can see a snapshot of historic performance of TrueWealth made on 09.03.2020, when the market, reaching its top, was hit by coronavirus:

TrueWealth historic performance, “highest growth” package

It’s clear that this robo advisor completely ingored the fact that the market is overheated the market correction caught it unprepared.

The reason for that is that instead of “advising”, this “advisor” invests in just three ETFs:

| Wertschriften | Stuckzahl | Wahrung | Preis | Preisdatum | Posotionswert | Anteil |

| UBS ETF (CH) – SMI (CHF) | 56 | CHF | 99,02 | 06.03.20 | CHF 5347.08 | 59.4% |

| Vanguard FTSE Emerging Markets ETF | 46 | USD | 40,11 | 06.03.20 | CHF 1711.47 | 19.0% |

| Vanguard US Total Market Shares Index ETF | 12 | USD | 150,59 | 06.03.20 | CHF 1676.24 | 18.6% |

Where does TrueWealth robo advisor invest

Why then paying additional management fees if you can invest in those ETFs directly?

Solid investment alternatives hidden below the radar

In recent years the investment universe has been focused on liquid instruments (i.e. securities like stocks and bonds that are traded on public exchanges) but it shouldn’t be forgotten that there still exists a vast ocean of alternative assets in the markets today.

Like a private business that operates in a stable but growing sector. An enterprise consistently producing healthy cash flow over the long-run. And a business that does not require onerous management. All this on top of chunky annual dividends for shareholders.

When this class of assets, flashing with all the right indicators, gets to the public market, they are snapped up like hotcakes.

That is if they ever even enter the public market. Of course with private companies the shares are illiquid, but for seasoned investors who like to get in for the long haul, this makes very little practical difference.

Robo-Advisors Vs Hidden Treasures

In recent times robo-advisors have completely transformed the investment landscape with fast, affordable and relatively effective options for mass affluent investors to finally access the market.

But there are some downsides to robo-advisers to bear in mind. So it would be wise not to put all one’s eggs in the robo-advisor basket. Ensure your portfolio is balanced and diversified by incorporating serious alternative assets.

All things considered, if you select just the right one, you might do well with a robo-advisor. But you might also become frustrated with the inherent limitations; such as being unable to go off radar, where the rising undercurrents expose the next hidden gems.

Sources

1. History of Robo Advisors – https://roboadvisors.com/history-of-robo-advisors